Whole Dude – Whole Slippery: The Repeal PRWORA Project

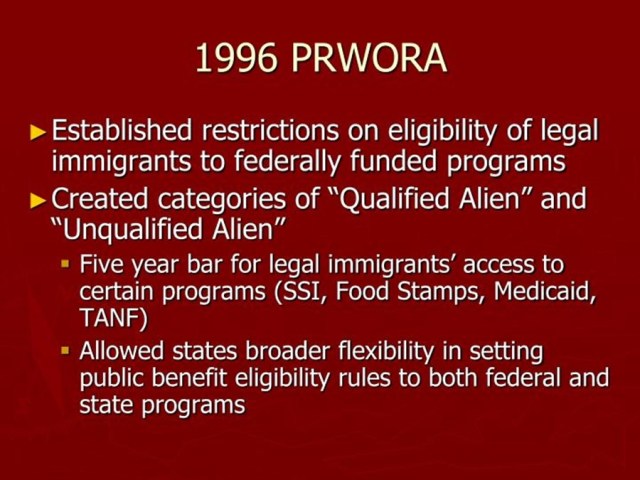

Excerpt: The “Repeal PRWORA Project” advocates for the repeal of Public Law 104-193, also known as the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) signed by US President Bill Clinton in 1996. The organizers argue that this law reintroduced varieties of slavery, including involuntary servitude and forced labor, by unfairly denying retirement income benefits to non-citizen taxpayers who cannot provide proof of lawful residency. Critics claim this law infringes on the constitutional rights of these workers, violating principles of equal treatment, protection, and justice under law. They demand for a strict adherence to the natural law principles abolishing any form of slavery.

In my analysis, the Economic Policy of President Bill Clinton is fundamentally flawed for it violated the principles of Natural Law that make America a proud and prosperous nation in the world. The economic downfall of the United States is relentless and is almost unstoppable. There can be no healing and no recovery without the Blessings promised by God and living up to the Official Motto “IN GOD WE TRUST.”

President Clinton’s Economic Policy to formulate a Balanced Budget is not consistent with LORD God Creator’s Economic Plan for the man in his golden years of his life. The issue is not that of Austere Spending or Deficit Spending Plans of the US Federal Government. God’s Plan clearly demands that the dignity of the man must be upheld in his Old Age when the man needs rest from daily labor to support his mortal existence.

Americans will give attention to my words after they fail to resolve the Economic Crisis through either Liberal or Conservative Spending Plans to revive the National Economy.

The Antislavery Campaign demands the Repeal of PRWORA of 1996 as it triggered ‘The Clinton Curse’ placing the US economy on a slippery slope. President Clinton did not Balance the US Budget for he acted in violation of God’s Commandments.

President Clinton missed the opportunity to save the country from foreign debt because he denied the payment of the Old Age Retirement Income and Health Insurance Benefits to alien workers who fully subscribed to the Social Security and Medicare Plans by paying the necessary taxes. To the same extent, ‘The Clinton Curse’ invites Americans to live their lives paying taxes to repay the foreign debt.

The concept of Spiritual well being always includes the dimension of the physical or the material well being of the man. In the present times, the physical or the material well being of the man always includes the concern about fair and just access to the economic resources to provide for the daily necessities of life particularly during old age after the attainment of the legally determined full retirement age.

Simon Cyrene

How Bill Clinton’s Balanced Budget Destroyed The Economy – Business Insider

Clipped from: https://www.businessinsider.com/how-bill-clintons-balanced-budget-destroyed-the-economy-2012-9

Bill Clinton is giving the keynote speech at the Democratic National Convention tonight.

The idea is to make people feel nostalgic for the last time when the economy was really booming, and hope that some of that rubs off on Obama.

However, in the New York Post, Charlie Gasparino uses the occasion to remind everyone that the seeds of our current economic malaise were planted during the Clinton years.

Basically, it was under Clinton that Fannie and Freddie really began blowing the housing bubble, issuing epic amounts of mortgage-backed debt.

The story that Gasparino tells is basically: Liberal Bill Clinton thought he could use government to make everyone a homeowner and so naturally this ended in disaster.

Gasparino specifically cites the controversial Community Reinvestment Act, a popular conservative bogeyman:

How did they do this? Through rigorous enforcement of housing mandates such as the Community Reinvestment Act, and by prodding mortgage giants Fannie Mae and Freddie Mac to make loans to people with lower credit scores (and to buy loans that had been made by banks and, later, “innovators” like Countrywide).

The Housing Department was Fannie and Freddie’s top regulator — and under Cuomo, the mortgage giants were forced to start ramping up programs to issue more subprime loans to the riskiest of borrowers.

That’s interesting. But the truth is far more complicated. And more interesting.

Clinton’s Budget Legacy

In addition to being remembered for a strong economy, Bill Clinton is remembered as the last President to preside over balanced budgets.

Given the salience of the national debt issue in American politics today, the surpluses are a major mark of pride for the former President (and arguably the entire country). They shouldn’t be.

“I think it is safe to say that we are still suffering the harmful effects of the Clinton budget surpluses,” says Stephanie Kelton, an economics professor at the University of Missouri Kansas City.

To understand why you first need to understand that the components of GDP look like this:

In the above equation, C is private consumption (spending). ‘I’ is investment spending. ‘G’ is government spending. And ‘X-M’ is exports-minus imports (essentially the trade surplus).

Here’s a chart of the government budget around the years during and right after Clinton, in case you need a reminder that the government was in surplus near the end of his tenure.

If the government is in surplus, it means that the government is taking in more cash than it is spending, which is the opposite of stimulus.

It’s also well-known that the US trade deficit exploded during the late 90s, which means that ‘X-M’ was also a huge drag on GDP during his years.

So the trade deficit was subtracting from GDP, and the government was sucking up more money from the private sector than it was pushing out.

There was only one “sector” of the economy left to compensate: Private consumption. And private consumption compensated for the drags from government and trade in two ways.

First, the household savings rate collapsed during the Clinton years.

And even more ominously, household debt began to surge.

So already you can see how the crisis started to germinate under Clinton.

As his trade and budget policies became a drag on the economy, households spent and went into debt like never before.

Economist Stephanie Kelton expounded further in an email to Business Insider:

“Now, you might ask, “What’s the matter with a negative private sector balance?”. We had that during the Clinton boom, and we had low inflation, decent growth and very low unemployment. The Goldilocks economy, as it was known. The great moderation. Again, few economists saw what was happening with any degree of clarity. My colleagues at the Levy Institute were not fooled. Wynne Godley wrote brilliant stuff during this period. While the CBO was predicting surpluses “as far as the eye can see” (15+ years in their forecasts), Wynne said it would never happen. He knew it couldn’t because the government could only run surpluses for 15+ years if the domestic private sector ran deficits for 15+ years. The CBO had it all wrong, and they had it wrong because they did not understand the implications of their forecast for the rest of the economy. The private sector cannot survive in negative territory. It cannot go on, year after year, spending more than its income. It is not like the US government. It cannot support rising indebtedness in perpetuity. It is not a currency issuer. Eventually, something will give. And when it does, the private sector will retrench, the economy will contract, and the government’s budget will move back into deficit.”

But this is only part of the story. What about what Charlie Gasparino wrote about above?

The Fannie and Freddie Boom

When the government is running a surplus, it no longer has to issue much debt. But risk-free government bonds are a crucial component of portfolios for all kinds of financial institutions, and for mom & pop investors who like the safety of regularly Treasury payouts. The yield on the 10-year bond was over 5% back in those days… nothing to sneeze at for people planning for a retirement.

This created a bit of a crisis.

Bond trader Kevin Ferry, a veteran of the scene, told Business Insider about the panic that was unfolding over the government’s lack of debt.

“OMG, they were all saying… there wasn’t going to be any paper!”

How did the markets react?

“Lo and behold… [Fannie and Freddie] issuance “SURGED” in the late 90s,” said Ferry.

Everything changed. While the government dramatically slowed down the issuance of Treasuries, Fannie and Freddie picked up the baton and started selling debt like never before.

“Prior to those years, there were not regular [Fannie and Freddie] auctions.”

“The system wanted it.”

“The fear was that there wasn’t going to be any…. There were no bill auctions.”

“The brokers were calling up ma & pa and said there are no more T-Bill auctions!”

And the data bears this out.

Total agency issuance of mortgage-backed securities spiked in 1998 and 1999, and from then on they never looked back.

Business Insider, Bloomberg

And just to drive home the point again, about how the 1998-1999 spike in issuance was the mirror image of the annual change in the size of the government debt.

Note that both government debt and agency issuance spiked in the early 2000s, but that was during a recession when the private sector dramatically scaled back its activity form the late 90s.

How Clinton Destroyed The Economy

The bottom line is that the signature achievement of the Clinton years (the surplus) turns out to have been a deep negative. For this drag on GDP was being counterbalanced by low household savings, high household debt, and the real revving up of the Fannie and Freddie debt boom that had a major hand in fueling the boom that ultimately led to the downfall of the economy.

And that brings up a broader question that people who advocate balanced budgets must answer.

What’s the point of it?

Despite the budget surplus, interest rates were higher. And the surplus provided no protection of the coming slump. And if anything, it just weakened the most brittle part of the economy: households.

Furthermore, there is a pattern of this.

Japan ran a budget surplus in the year right before its economy went into terminal decline, as this chart from Trading Economics shows

So while Clinton will be remembered nostalgically tonight, for both the performance of the economy and his government finances, they shouldn’t be remembered fondly.

All said and done, President Clinton’s Evil Plan failed to resolve the problem of National Debt. The Repeal Movement exposes President Clinton’s contemptuous violation of Constitutional Principles of equal protection, equal justice and equal treatment under Law.