Whole Dude – Whole Debt: The Repeal PRWORA Project

Excerpt: The “Repeal PRWORA Project” advocates for the repeal of Public Law 104-193, also known as the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) signed by US President Bill Clinton in 1996. The organizers argue that this law reintroduced varieties of slavery, including involuntary servitude and forced labor, by unfairly denying retirement income benefits to non-citizen taxpayers who cannot provide proof of lawful residency. Critics claim this law infringes on the constitutional rights of these workers, violating principles of equal treatment, protection, and justice under law. They demand for a strict adherence to the natural law principles abolishing any form of slavery.

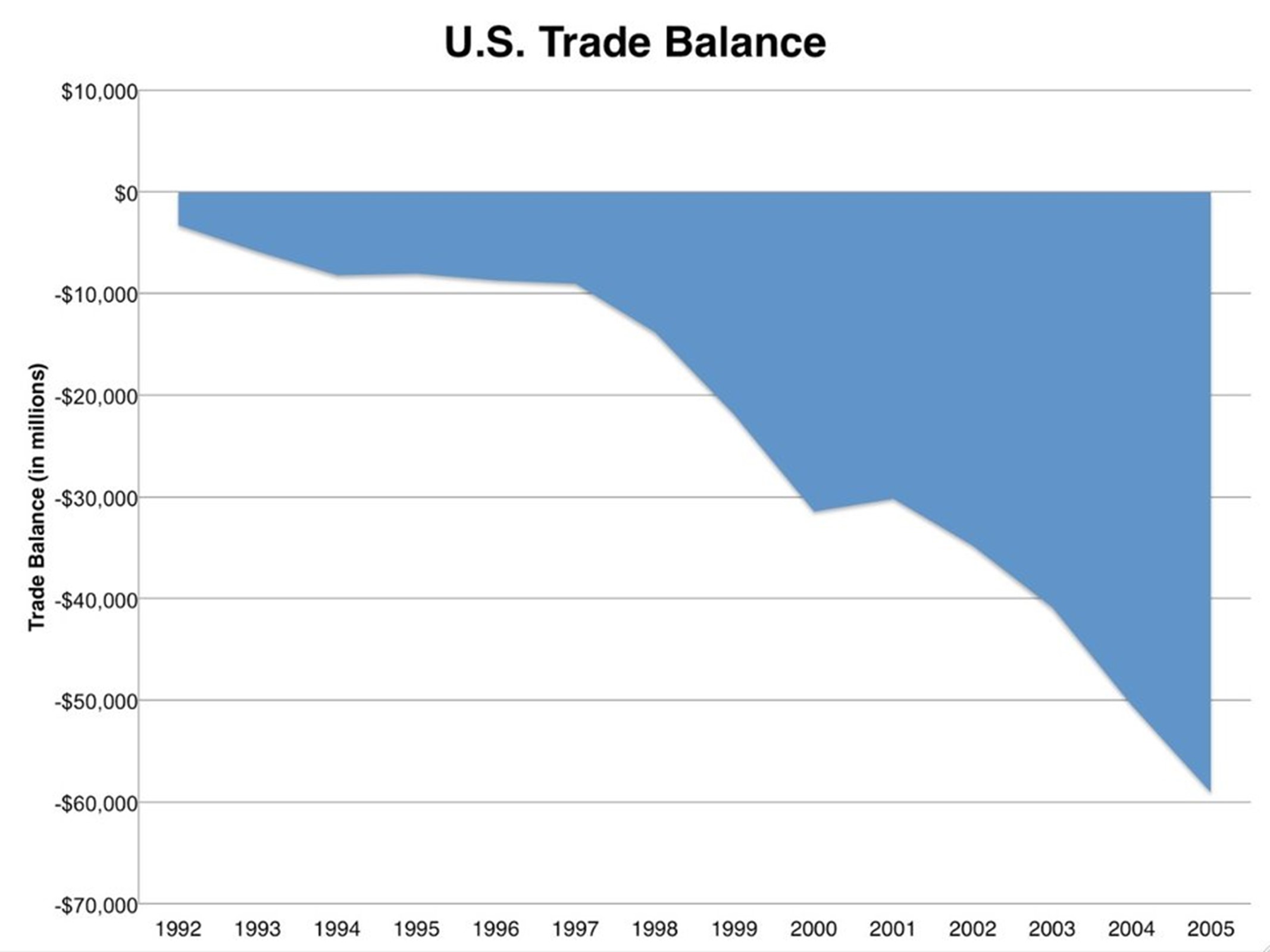

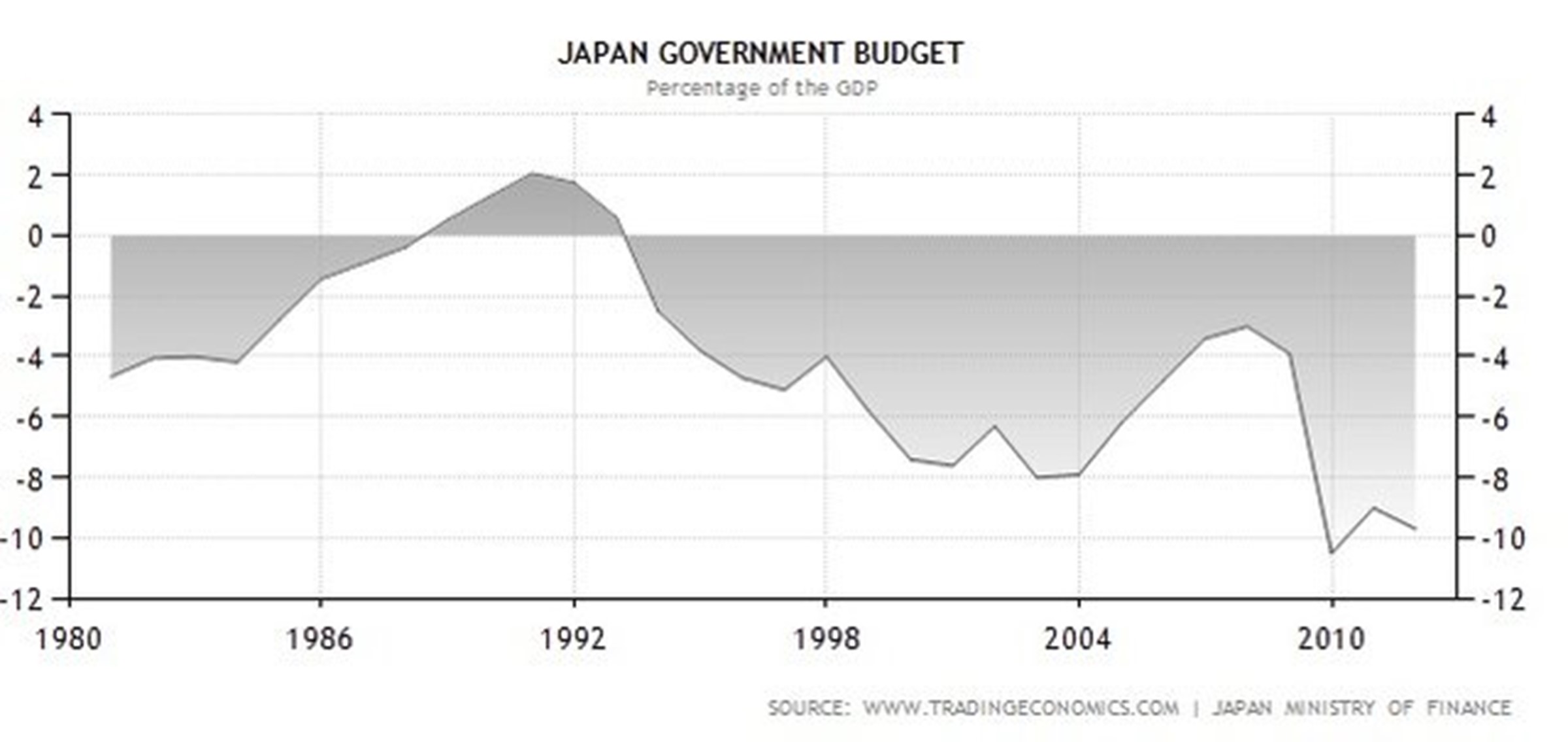

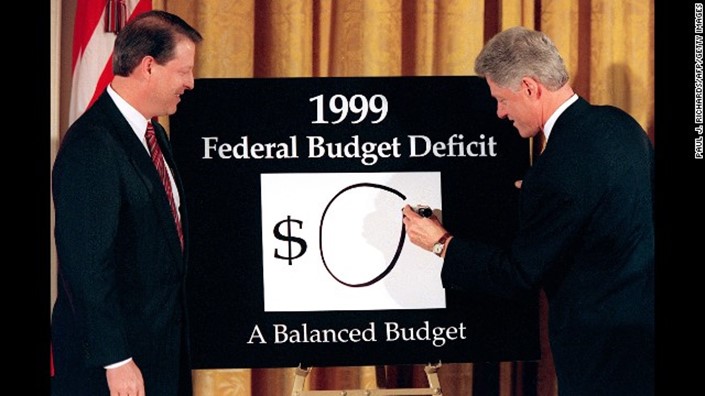

I ask my readers to make the distinction between Budget Deficit and Foreign Debt. I describe the phrase ‘The Clinton Curse’ from reading the Book of Deuteronomy which specifically mentions the Curse relating to a debt owed to foreign nations.

In my analysis, ‘The Clinton Curse’ demands the Repeal of Bill Clinton’s Slavery Law called PRWORA or The Welfare Reform Act of 1996.

SURPRISE! The budget deficit is soaring! 🚀🚀🚀

Here’s a headline you might have missed amid the onslaught of news about Julian Assange, William Barr, Nipsey Hussle, and Michael Avenatti:

“US budget deficit running 15% higher than a year ago.”

The story cites this monthly report from the Treasury Department detailing these few eye-popping facts:

1) The budget deficit grew $146.9 million in the month of March alone.

2) The deficit for this fiscal year is now $691 billion — a 15% increase (or roughly $100 billion) from where we were at this point in 2018.

3) Treasury is projecting that the deficit will surge over $1 trillion by the end of the fiscal year in September.

To which, our politicians have responded: 😒

“Nobody cares,” White House chief of staff Mick Mulvaney reportedly told a group of Republicans who wondered why President Donald Trump wasn’t going to mention the ever-growing deficit in his State of the Union Speech earlier this year.

That’s a massive change from where Trump, Mulvaney and the rest of the Republican Party were on the dangers of debt and deficits just a few years ago. Here’s Trump talking to Sean Hannity in 2016 about how easily he will balance the federal budget:

“It can be done. … It will take place and it will go relatively quickly. … If you have the right people, like, in the agencies and the various people that do the balancing … you can cut the numbers by two pennies and three pennies and balance a budget quickly and have a stronger and better country.”

So, well, it hasn’t turned out that way. At all.

Here’s the kicker: Trump isn’t likely to pay a price — either within his own party or the broader electorate — for the soaring deficit. Less than 50% of people in a January Pew poll said that lowering the federal deficit should be a top priority of Washington policymakers. That’s down, rapidly, from 72% who said the same earlier this decade.

The Point: Deficits have lost their salience as a political issue. But that doesn’t mean they are going away. And, at some point, our political (and economic) systems will be forced to deal with our growing mountain of debt.

— Chris

How the U.S. Deficit and Debt Are Different?

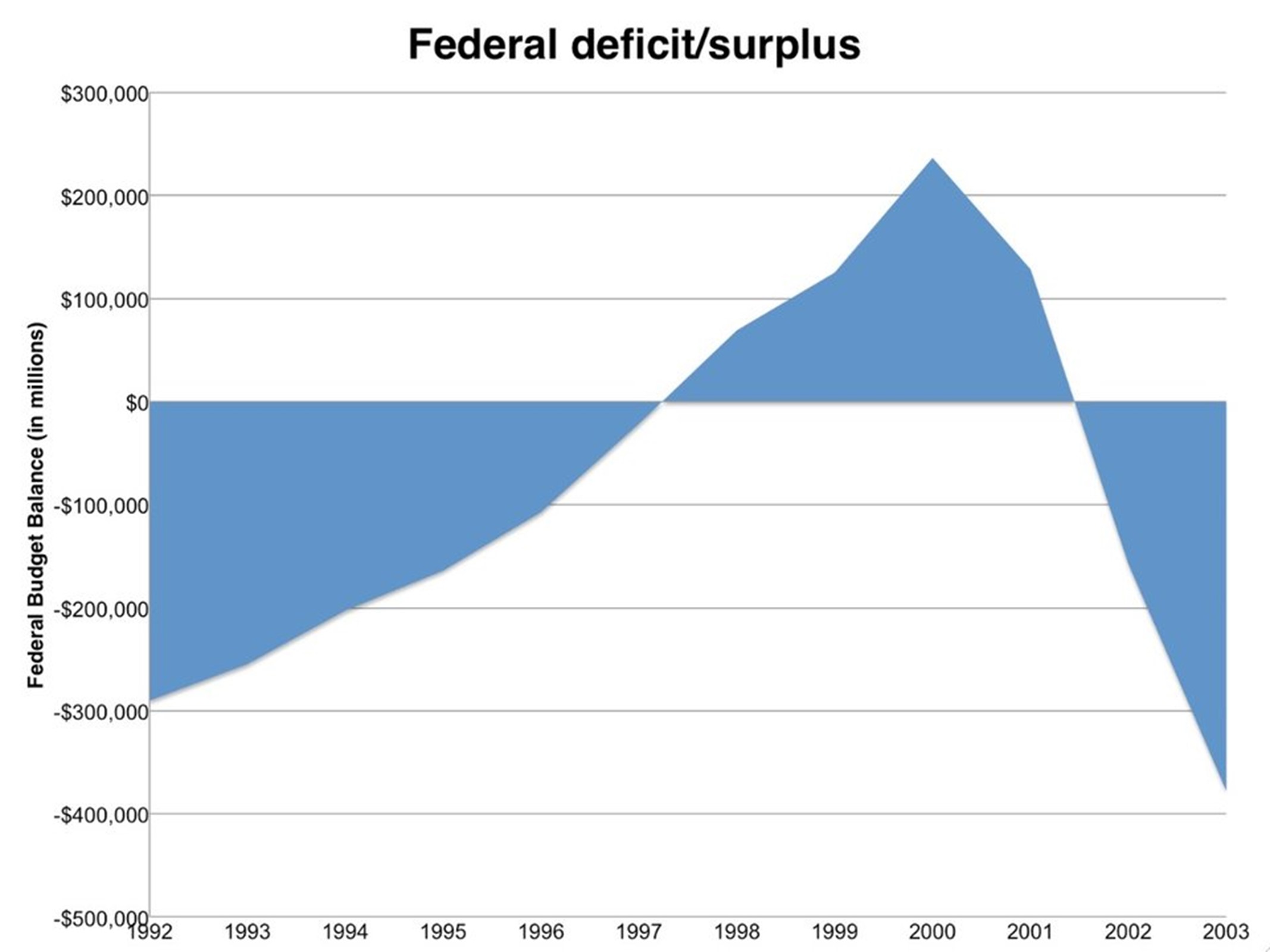

The U.S. budget deficit was $211 billion in August 2018. That’s much lower than the record high of $1.4 trillion reached in FY 2009.

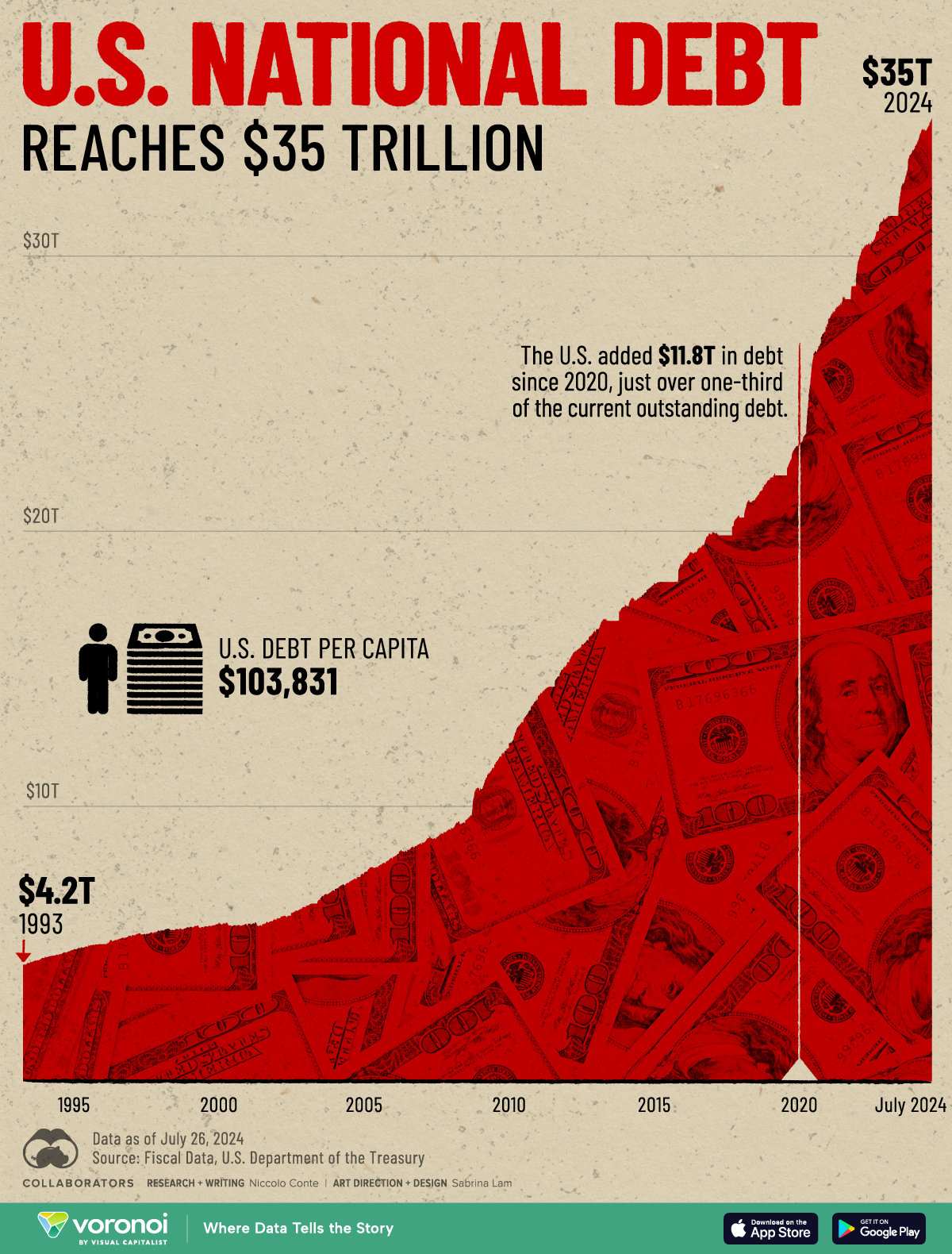

The U.S. debt exceeded $22 trillion on February 11, 2019. That’s more than triple the $6 trillion debt in 2000.

What is Foreign Debt?

Foreign debt is an outstanding loan or set of loans that one country owes to another country or institutions within that country. Foreign debt also includes obligations to international organizations such as the World Bank, Asian Development Bank or Inter-American Development Bank. Total foreign debt can be a combination of short-term and long-term liabilities. Also known as external debt, these outside obligations can be carried by governments, corporations or private households of a country.

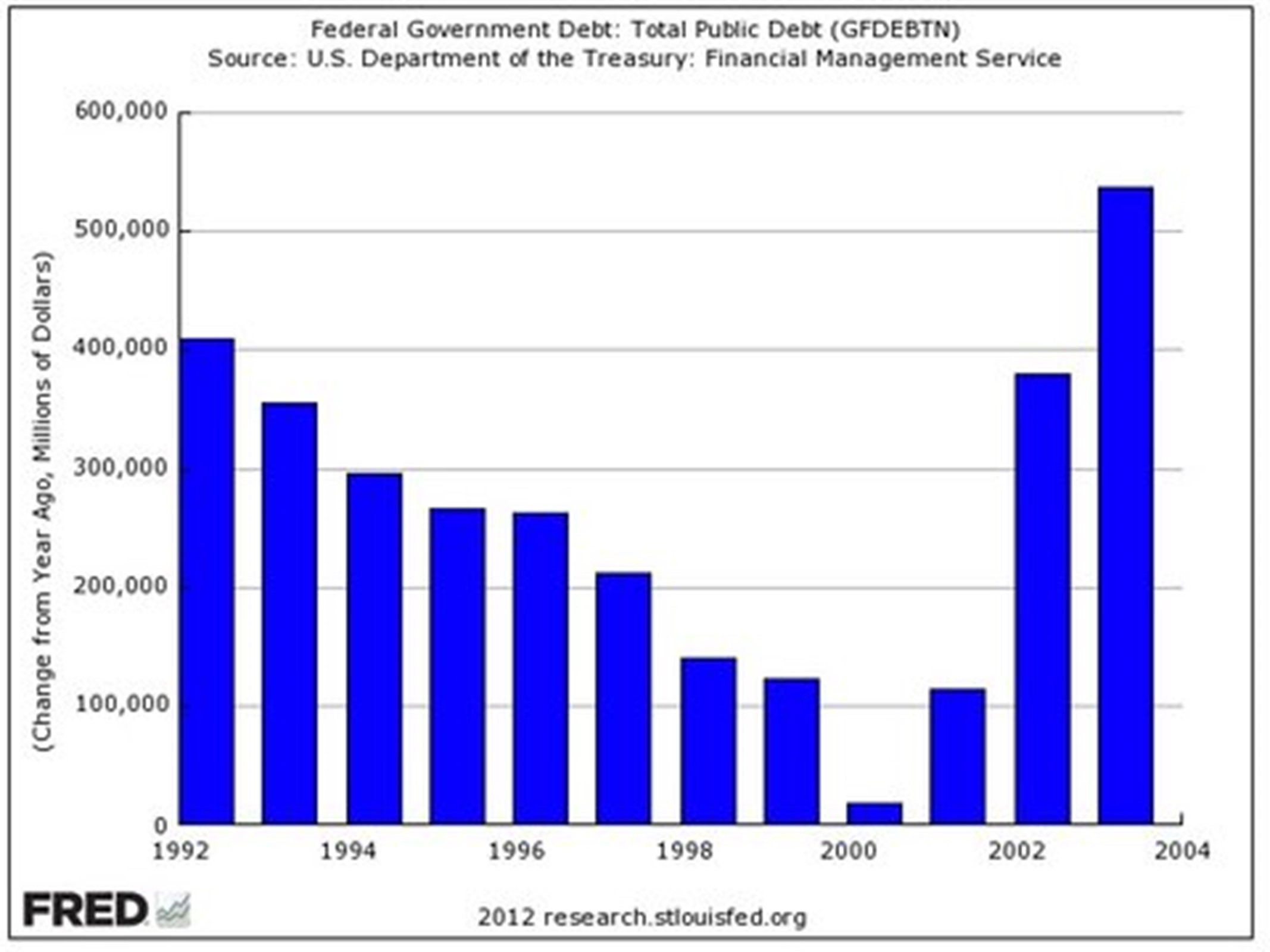

In fact, the national debt went from $4.4 Trillion at the end of 1993 to almost $5.7 Trillion at the end of 2000, U.S. Treasury data shows, a 28 percent increase in the debt over this time when our nation supposedly was running a balanced budget.

The reason for the confusion is that the reported budget deficit/surplus does not take into account new debt being incurred by the Social Security and Medicare Trust Funds and other government loan programs. So, when the budget appeared to have gone down by $69 billion in 1998, the national debt increased by $109 billion, similarly, in 1999, the budget surplus appeared to be $126 billion, the actual national debt rose from just under $5.5 trillion to just over $5.6 trillion.